The Michigan legislature has given the green light to a new auto insurance deal.

House lawmakers passed it in a 94-to-15 vote Friday afternoon, and then the Senate passed the plan, 38-4, Friday night.

The plan is said to prohibit insurance companies from setting rates based on non-driving factors like credit scores and zip codes, and it reportedly calls for a choice of medical coverage levels for drivers while giving medical providers a more structured compensation level. The bill now moves to the Senate, where it is expected to be passed. Governor Gretchen Whitmer said that she plans to sign it.

Governor Gretchen Whitmer (D) statement:

“Today’s vote is truly historic. We’ve accomplished more in the last five months than in the last five years. This vote demonstrates that when both parties work together and build bridges, we can solve problems and make life better for the people of Michigan.

“This plan will help drivers from Detroit all the way to the U.P. It guarantees lower auto insurance rates for eight years, protects people’s choice to pick their own insurance and coverage options while preserving the safety net, and bans insurance companies from using discriminatory non-driving factors when setting rates.

“We still have more important work ahead of us to build a stronger Michigan for everyone. Now we must seize on this momentum to pass a strong, bipartisan budget that raises the revenue we need to improve education and skills training, clean up our drinking water, and fix the damn roads. Let’s get to work, and let’s get it done.”

State Sen. Ed McBroom (R-Vulcan) statement:

“Drivers in the Upper Peninsula and throughout Michigan pay the most expensive car insurance rates in the country — the system is broken, and today we acted to fix it,” said McBroom, R-Vulcan. “I am glad that we were able to come together to approve this long-overdue reform to help make driving in our state more affordable for everyone.”

“The extreme high cost of auto insurance is the number one issue I heard about from constituents,” McBroom said. “All of us are looking forward to the relief our families, businesses and communities will have from these significant changes.”

State Rep. Beau LaFave (R-Iron Mountain) statement:

“Although it took longer than we would’ve liked, I’m pleased we were able to get the governor and her special interest allies to agree on a solution to the largest pocketbook issue burdening Upper Peninsula drivers. This is a huge victory for Michigan families despite Gov. Whitmer’s several failures to score a home run for medical providers, ambulance-chasing lawyers and insurance companies. This solution allows drivers to opt out of medical coverage through their car insurance policies in spite of the governor claiming it was a ‘non-starter.’ I urge her to sign these historic reforms as soon as they reach her desk so drivers can receive the guaranteed rate relief they have long asked for and deserve.”

State Rep. Sara Cambensy (D-Marquette) statement:

“After another week of negotiations to reform Michigan’s Auto No-Fault laws, we made further progress to save constituents money by passing a monumental change in our car insurance laws. Most important to me, we gave the Attorney General and the Department of Insurance and Financial Services back the authority to go after the estimated $800 million in fraudulent no-fault claims each year. This exorbitant number shows just how out-of-control fraudulent car insurance claims in Michigan have become, and why we had to send a clear message today that that fraud will not be tolerated any longer.

“Every major interest group involved in no-fault insurance took a hit with this bill. Today’s vote was a vote that the people of Michigan adamantly demanded and rightfully deserved. This bill makes big changes and is not perfect. While the work is not done and there is more we can do, this is a huge step forward for Michigan families and our state.”

State Sen. Wayne Schmidt (R-Traverse City) statement:

“This was a somewhat difficult decision for me because the benefits that traumatic accident victims receive is second-to-none.

“However, we cannot continue to ignore the skyrocketing rates that are causing Michigan families to be priced out of driving. People have a choice when selecting any other type of insurance and I think auto insurance should be the same way.

“If you want to pay for the Cadillac benefits, then you should be able to. If you simply can’t afford the full-scale package, you should have the option to get something that still reasonably protects your family. The fact is it should be based on the needs of your family and your budget.

“The plan approved today would do just that. It addresses the numerous causes of Michigan’s high rates, but most importantly, it gives people a choice.

“My colleagues and I have worked tirelessly on this issue since the beginning of the new term and I am happy we were able to reach an agreement with the administration and get this done for the many hardworking Michigan families across the state.”

Michigan Attorney General Dana Nessel (D) statement:

“After reviewing today’s legislation that overhauls Michigan’s auto insurance system, I feel confident that the Attorney General’s office will have the statutory tools we need to vigorously and thoroughly investigate and prosecute auto insurance fraud in Michigan.

“Once this legislation is signed into law, our office will continue to do what we do best: investigate and prosecute crime. To that effect, I look forward to expanding our cooperative relationship with the Department of Insurance and Financial Services so our collaborative efforts can have the greatest impact on protecting Michigan citizens. There are few places where this is more important than in the insurance industry where our team is laser focused on protecting drivers from price gouging and other shameful tactics that have been used in the past.”

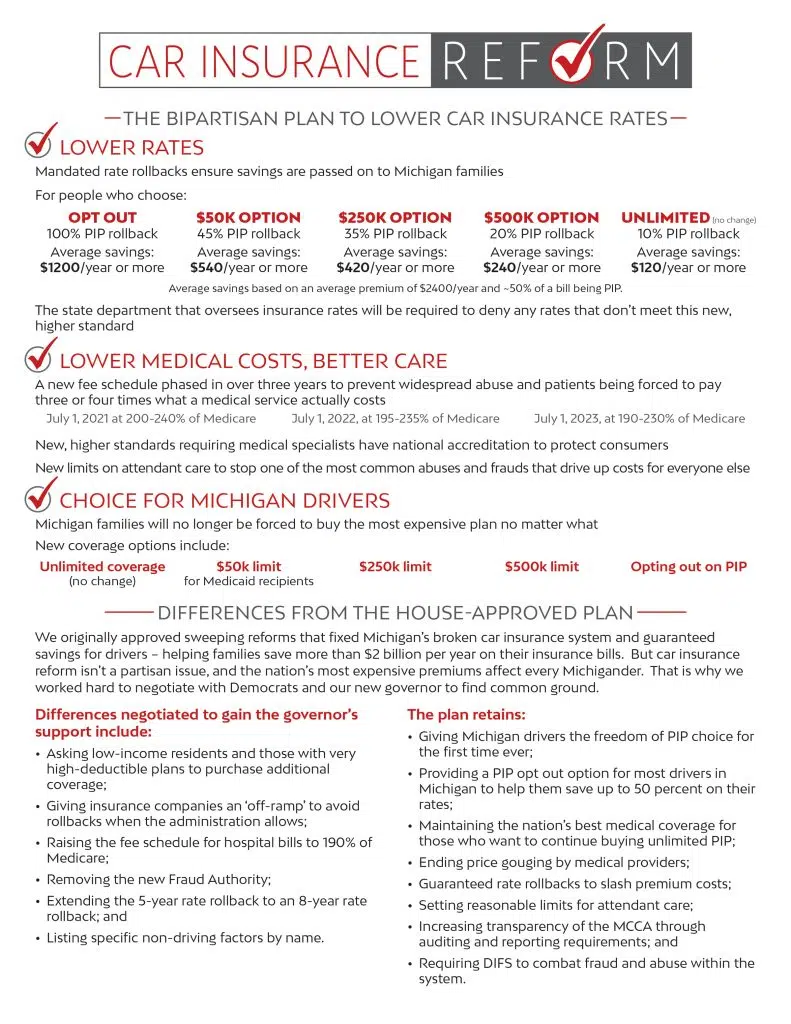

Key components of the plan, according to McBroom, include:

- Requiring auto insurers to provide customers with a range of personal injury protection (PIP) options, including the ability to opt out of PIP coverage entirely if an individual has other qualified health coverage, including Medicare, a $50,000 policy for Medicaid enrollees, a $250,000 policy, a $500,000 policy, and an unlimited medical benefit policy;

- Reducing the annual per-vehicle Michigan Catastrophic Claims Association fee by 80% for all above options other than unlimited;

- Strengthening the insurance fraud division within the state Department of Insurance and Financial Services to empower law enforcement to crack down on auto insurance fraud;

- Ending excessive health care costs related to auto insurance claims by implementing a fee schedule to cap the amount providers can charge for care offered; and

- Eliminating or regulating many nondriving rating factors, such as sex or marital status, to ensure a level playing field.